Budget Analysis 2022

Budget – The Journey so far and The Way Forward

Mrs Nirmala Sitharaman presented her fourth budget for FY2022-23. While the first budget of hers did not go down well with the corporate, the common man and the free market leaning economists, she was forced to roll back most of the adverse measures then. The second budget was made redundant by Covid and she reworked every aspect of that budget right from revenue projections to allocations to subsidies and the deficit targets.

The third Budget presented by her in Feb 2021 was a well thought out budget focusing on making the budget more transparent by disclosing off balance sheet items like Food Corporation of India loans and absorbing it into the books of Govt of India and the budget focused on several strategic moves like divestment of LIC and increasing the capital expenditures to boost economy. When an economy is in a crisis, the Govt has two options to revive the economy. Option 1 is to go for helicopter money by transferring cash directly to the affected, and option 2 is to spend more on infrastructure, and revive the economy. While most of the Western countries opted for option 1, India chose option 2 in Budget 2021.

The Surprise Factor in Tax Windfall!

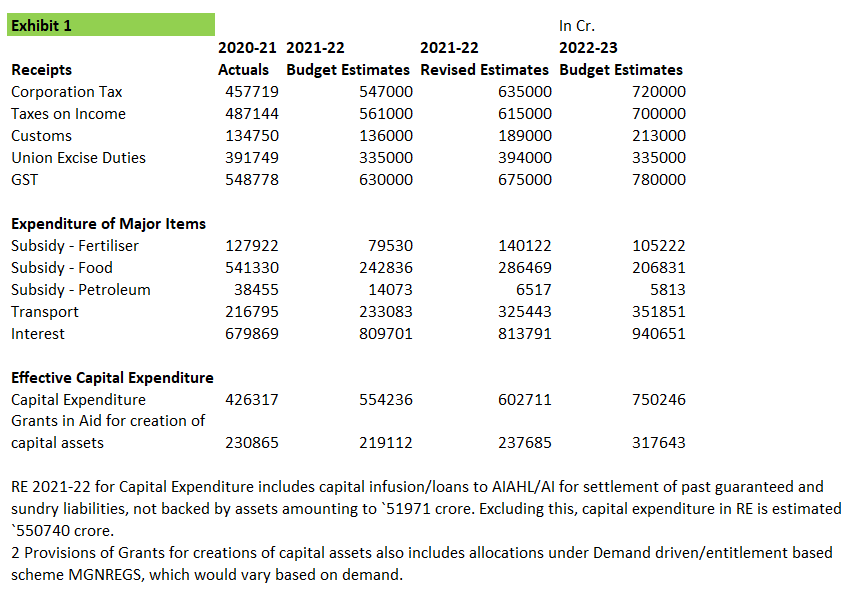

Corporate Tax collection is expected to touch 635000 cr this fiscal against 457000 cr collected last fiscal increasing by a whopping 38%. Personal Incomes tax is expected to touch 615000 cr this fiscal against 487000 cr collected last fiscal. Central GST too is expected to touch 675000 cr this fiscal against 548000 cr collected last year.

GDP has just limped back to pre-Covid levels but Tax Collections have surged big time as evident from the above data. This is a huge windfall for the government.

The windfall was used to foot the fertiliser subsidy for the farmer (61000 cr) to insulate him from increase in global fertiliser prices. Govt repaid the borrowings of Air India to the tune of 51000 cr (accumulated debt and losses) before divesting it to Tatas, increased spending on building roads and supporting railways to the tune of 95000 crore, and reducing the fiscal deficit from 9.2% to 6.9%.

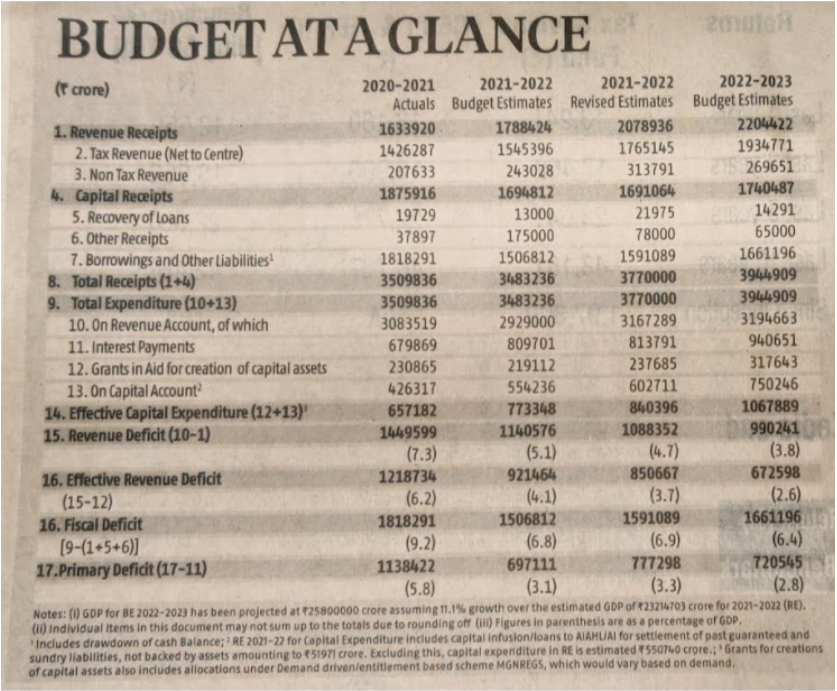

This increase in revenues and expenditure is captured in the Exhibit 1 below.

Source : Budget Documents

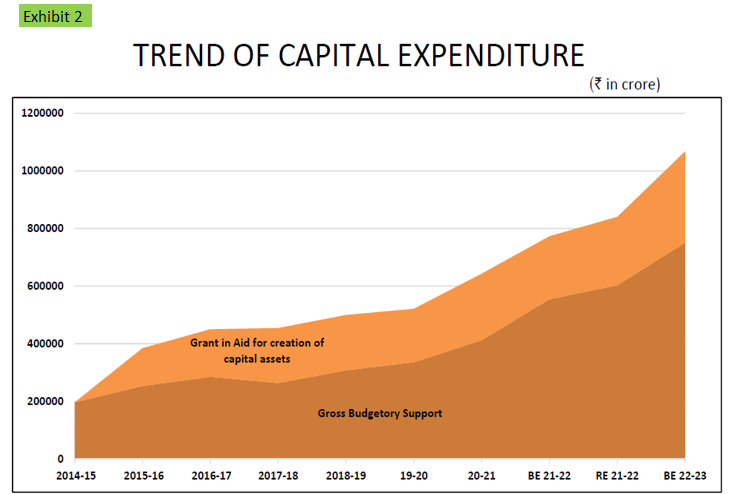

The policy of the government is clear from what it did over the last 24 months – It doesn’t subscribe to the policy of stimulating the economy through helicopter money. Instead, it wants to stimulate the economy through enhanced capital expenditure. The increase in Capital Expenditure over the last few years is captured in Exhibit 2.

Source : Budget Documents

Budget 2022

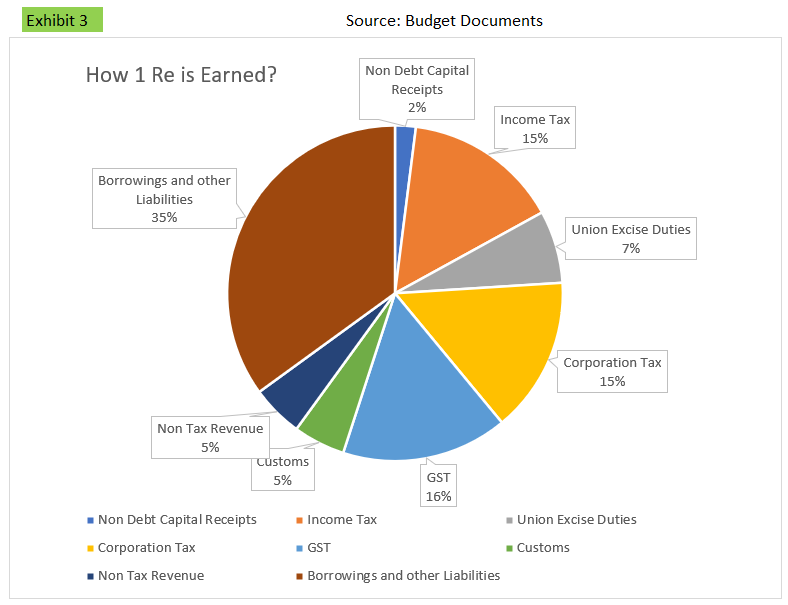

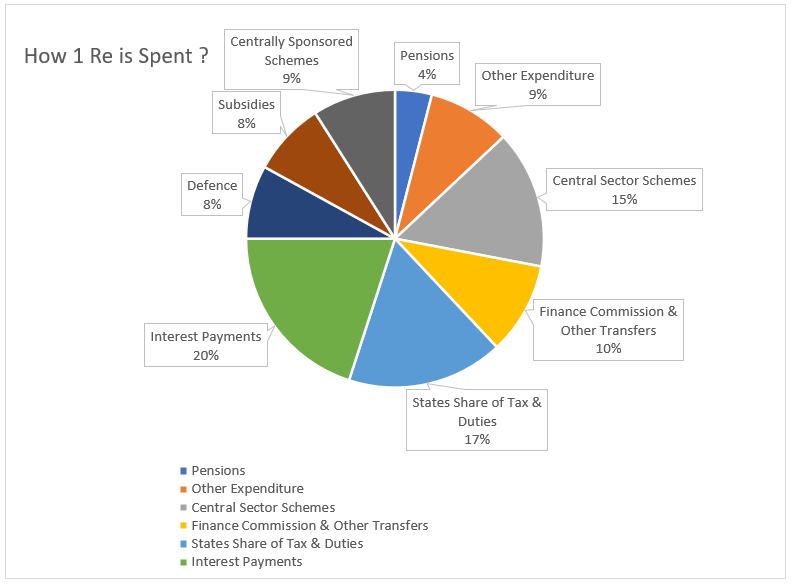

Budget 2022 in short is continuity of Budget 2021 – Focusing on Capital Expenditures, increasing tax revenues and Strategic Divestments while bringing down fiscal deficit further to 6.4%. The essence of the Budget is captured in Exhibit 3 and Exhibit 4. Exhibit 3 throws light on how GOI earns a rupee and how it spends the same. Exhibit 4 summarises the Budget workings.

Exihibit 4:

Source : Business Standard

Salient Features of the Budget 2022

1. No change in Personal Income tax slabs

2. No change in taxation of Dividends and Buybacks

3. Cryptocurrency gains to be taxed at 30% without any carried forward loss provisions

4. Fiscal Deficit target of 6.4% implying a nominal GDP growth rate of 11.1%

5. Expects Personal Income Tax and Corporate tax collections to grow by 14%

6. Expects GST collections to increase by 15%

7. Provisions made to build/upgrade 25000 kms of National highways

8. Allocation for rural roads increased to 190000 cr from 140000 cr

9. Allocation to piped water for all scheme increased to 60000 c from 45000 cr

10. Allocation to PM Awas Yojana – housing scheme increased to 48000 cr from 27000 cr

11. 400 new Vande Bharat trains to be launched over the next 3 years

12. Disinvestment targets to hover around 70000 cr

13. Capex Expenses to touch 750000 cr mark.

What is in store for us?

The fact that there are no tax increases both on the corporate and the personal tax front augurs well for our investments. The budget assumptions are realistic and we feel the Budget targets can be met provided there are no further lockdowns like the one seen in Mar-June 2020.

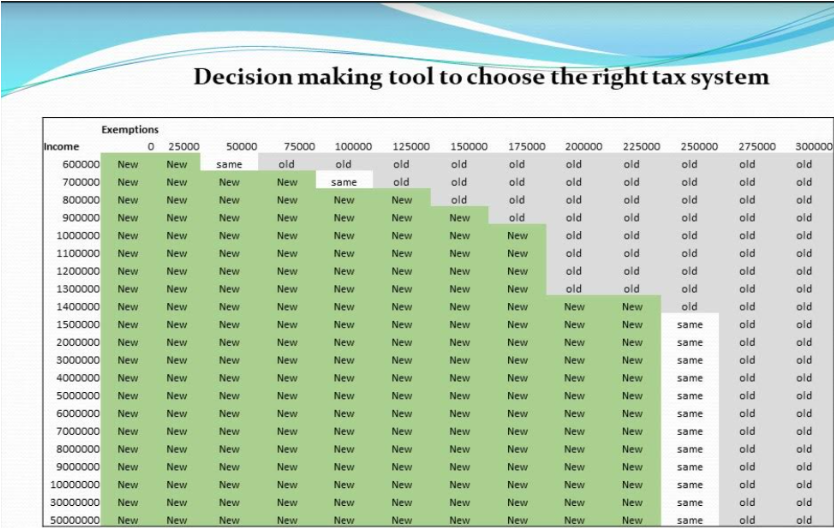

Many expected the FM to sugar coat the new personal tax regime and make it more attractive. However, she has maintained status quo. A decision-making tool which was devised by us last year to enable a tax payer to choose the right taxation system is appended to this newsletter as Exhibit 5. We hope the exhibit will make your life simpler in choosing the optimal tax regime.

The move of the FM to tax gains from crypto currencies at 30% will not alter our views on Investing in them. Crypto currencies are illegal and do not fit into the definition of an asset. Hence, we will not invest in them and take irrational, undue risks.

The benchmark Sensex has reacted positively to the Budget and is up by more than 1000 points over the last 2 days as the Budget ticked the right boxes on the infrastructure front and there were no tax increases. Sensex movements in the shorter run will be volatile and largely determined by happenings in USA, Ukraine and UP election results. Sensex earnings are expected to grow by more than 15% next fiscal. The Budget assumes a nominal GDP growth of 11.1% and increase in corporate tax collection by 14%.

Markets are factoring in an at least 15% growth in Sensex earnings for next FY. This earnings growth trajectory will be the driver in the medium run while the underlying demographics of the country remains the long-term driver. The Budget doesn’t alter our Investment Philosophy. We will continue to buy into good businesses at reasonable price, stick to asset allocation in line with our client’s risk appetite and requirements, build a robust portfolio, manage the risks prudently to take care of the life goals of our clients.

Prudent Investors are advised to stick to their asset allocation strategies, stay invested, make best use of any correction like the one which happened a fortnight back, invest more and reap the benefits in the longer run. We will be happy to translate very such opportunity to growth for our Investors.

Warm Regards,

Team T.Ram

Feb 03 2022

Exhibit 5:

Note:

New – Opt for New Tax Regime

Old - Opt for Old Tax Regime

Same – You can opt for either